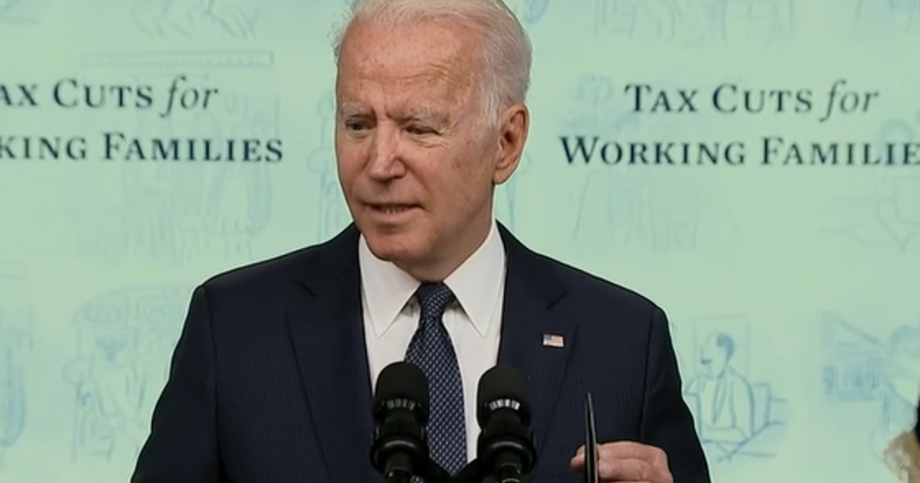

President Biden celebrates “life-changing” month-to-month Little one Tax Credit score funds as first checks exit

President Biden hailed the second as historic because the households of practically 60 million kids are receiving roughly $15 billion within the first month-to-month funds of the superior Little one Tax Credit score. President Biden and Democratic lawmakers hope the cash, a part of the newest spherical of COVID-19 pandemic reduction handed earlier this 12 months, is just the start.

The American Rescue Plan, which was signed into legislation in March, expanded the Little one Tax Credit score to $3,600 per baby youthful than six and $3,000 per baby ages six to 17. It additionally made the tax credit score totally refundable and superior half of it to households as month-to-month installments.

Households with kids six years previous and youthful will obtain $300 per baby every month, whereas households with kids six to 17 will obtain $250 for every of the following six months.

“This may be life-changing for therefore many households,” Mr. Biden mentioned. He argued the expanded month-to-month Little one Tax Credit score has the power to chop poverty in the best way Social Safety lowered poverty among the many aged. He claimed the expanded Little one Tax Credit score might be one of many issues he and Vice President Kamala Harris might be most pleased with when their time in workplace is up.

Harris referred to as Thursday “the day the American household bought a lot stronger.” She mentioned whereas the funds could be month-to-month, the impression might be generational.

“For the primary time in our nation’s historical past, American working households are receiving month-to-month tax reduction funds to assist pay for necessities like physician’s visits, college provides, and groceries,” Treasury Secretary Janet Yellen mentioned in an announcement. “This main middle-class tax reduction and step in lowering baby poverty is a outstanding financial victory for America – and likewise an ethical one.”

About 86% of households receiving funds are getting them through direct deposit. The rest will obtain checks within the mail, the Treasury Division mentioned.

Coverage consultants say the transfer will slash the kid poverty price in the USA practically in half, with a fair larger impression for Black and Hispanic kids. Earlier than modifications have been made underneath the American Rescue Plan, decrease revenue households typically obtained a smaller Little one Tax Credit score than households with increased earnings as a result of the tax credit score was solely partially refundable. The households of greater than 26 million kids who beforehand would haven’t obtained the total Little one Tax Credit score as a result of their incomes have been too low underneath the previous guidelines will now obtain the total credit score.

“It is essentially the most progressive change to America’s tax code ever,” mentioned Senator Michael Bennet of Colorado on Wednesday. He launched a plan to overtake the Little one Tax Credit score and ship funds on a month-to-month foundation within the Senate again in 2017. “It is the only largest blow to baby poverty in American historical past.”

Democrats — a few of whom, like Connecticut Consultant Rosa DeLauro, have lengthy advocated related insurance policies — are pushing to increase the month-to-month Little one Tax Credit score funds past 2021. As a part of his proposed American Households Plan, Biden has referred to as for the month-to-month funds to be prolonged by means of the tip of 2025.

“To the individuals who say we won’t afford to provide the center class a break, I say we are able to afford it, by making individuals on the prime and the massive companies, over 50 of which paid no taxes final 12 months in any respect, to lastly simply begin paying their justifiable share,” Biden mentioned.

Whereas members of the Senate hash out a bipartisan infrastructure deal, Democrats are additionally getting ready to make use of the so-called reconciliation course of that enables them to go different parts of the Biden agenda while not having 60 votes within the Senate. The elevated month-to-month Little one Tax Credit score funds can be a part of that $3.5 trillion funds decision. Discussions on how lengthy to increase it are ongoing, however Senator Ron Wyden of Oregon, whose Senate Finance Committee can be accountable for drafting it, has mentioned his purpose is as lengthy of an extension as potential.

“Will probably be prolonged for certain for a really important period of time, and we’ll see if we are able to get the permanence that we’re combating for,” Senate Majority Chief Chuck Schumer of New York mentioned at a press convention final week on the matter. He reiterated his name to make the expanded tax credit score a everlasting a part of the tax code Monday on the Senate ground.

Some Republican lawmakers have proposed their very own month-to-month funds for youngsters, however none are anticipated to get on board with the Democratic model being handed as a part of a reconciliation bundle. No Republicans voted for the American Rescue Plan, which included the momentary elevated Little one Tax Credit score.

Youngsters advocacy teams are additionally pushing to make the growth everlasting — arguing it can’t be left as much as future lawmakers to make sure the advantages going to thousands and thousands of households proceed.

“We discuss quite a bit about probably reducing baby poverty in half, however in the event you simply flip your perspective on that, permitting this program to run out in some future 12 months is akin to mainly permitting a doubling of the kid poverty price when this coverage goes away,” mentioned Zach Tilly of the Youngsters’s Protection Fund.

Within the meantime, lawmakers, advocacy teams and the Biden administration have been working to convey consciousness to the month-to-month funds and ensure low revenue Individuals who’ve to not file taxes are within the tax system to obtain the funds.

The primary funds robotically included households that signed up for stimulus checks final 12 months, even when they don’t usually file tax returns due to their low incomes. Consequently, the households of greater than 720,000 kids who wouldn’t in any other case have obtained a Little one Tax Credit score will now obtain funds beginning this month, the Treasury Division estimates.

And outreach continues. The IRS over the weekend held a sequence of occasions in 12 cities throughout the nation over the weekend to assist individuals who do not usually file taxes to get the funds and arrange a sequence of on-line instruments to assist non-tax filers eligible for the kid tax credit signal as much as obtain funds in addition to examine their eligibility for funds. Even when households enroll late for the Little one Tax Credit score funds, they’ll nonetheless obtain the total quantity of superior funds by the tip of the 12 months, a senior administration official mentioned.

On Monday, the IRS expanded a few of its baby tax credit score materials to Spanish and different languages to assist attain eligible households. Different teams have launched a sequence of public consciousness campaigns on a number of platforms.

To obtain the total quantity, eligible households embody single guardian head of family filers making as much as $112,500 and married {couples} who file collectively with a mixed revenue as much as $150,000 per 12 months.